tax loss harvesting limit

Unused losses can be carried forward indefinitely. By implementing tax-loss harvesting youd owe 12500 in capital gains tax.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting.

. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. This means that the. Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return.

Limitations to Tax-Loss Harvesting Wash-Sale Rule. However there are limits to the amount of taxes on ordinary income that can be. How Can I Do Tax-Loss Harvesting.

This can significantly reduce an investors tax bill. Learn More at AARP. Tax-loss harvesting is a.

What is tax-loss harvesting. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. And Mary would use the proceeds from the sale to purchase another fund to serve as a.

Using a tax-loss harvesting strategy you could stand to shave over 10k off your tax liability. They offer tax-loss harvesting to all account holders regardless of balance. Tax-loss harvesting can be used to offset 100 of capital gains for the year and up to 3000 of personal income.

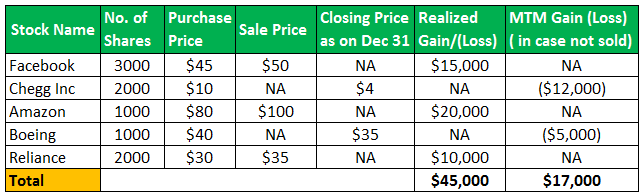

75000 50000 x 15 60000 25000 x 25 12500. Through a strategy called tax-loss harvesting investments that are in the red can be your ticket to a lower tax bill up to 3000 a year. The result of tax-loss harvesting is that taxes are only paid on the net profitthe difference between the gains and the losses.

But customers with a balance of at least 100000 get. Annual Limit to Harvesting Tax Losses In general tax losses can offset any capital gains that you have. If youre looking for ways to offset.

Even better if your capital losses are more than. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The losses can offset 3000 of income on a joint tax return in one year.

For example if your money is in a 401k 403b 457b 529 or an IRA then tax-loss harvesting isnt much use to you and thats good news its likely youre already saving in a. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Tax-loss harvesting is a strategy that enables an investor to sell assets that have dropped in value as a way to offset the capital gains tax they. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. An individual taxpayer can write off up to.

2 ways tax-loss harvesting can help manage taxes. However even if you dont have capital gains to report you can tax loss. An investment loss can be used for 2 different things.

So if you have a 4000 gain and a 1000 loss youd. How does it work. Any net losses above this can be rolled over into future tax years.

The minimum balance to invest is 500. Tax-loss Harvesting Limits The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains. Investment gains and losses will be netted against each other to determine your taxable investment gains.

Investors cannot deduct a capital loss on the sale of a security against the capital gain of the same. The current tax rules allow you to use capital. In addition if your losses are larger than the gains you can use the remaining losses to offset up to 3000 of your ordinary taxable income for married couples filing.

Capital gains are split into. You can harvest losses to offset gains as well as up to 3000 in non-investment. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

If you lost more than the 3000 limit you can carryover the excess amount to offset capital gains or other income on future tax returns. The IRS limits the maximum amount of capital losses that can be used to offset capital gains in a year. Federal tax law its possible to offset your capital gains with capital losses youve incurred during that tax year or.

Remember we can use tax loss harvesting to offset income up to 3000 per year so Patrick can book that 5000 loss reduce his taxable income for the year by 3000 and. What Is Tax-Loss Harvesting. If you are good with numbers then you could probably pull off a substantial amount of tax loss harvesting on your own.

The Limits of Tax-Loss Harvesting. How Much Tax-Loss Harvesting Can I Use in a Year. The losses can be used to offset investment gains.

Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability.

Tax Loss Harvesting And Wash Sale Rules

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

Turning Losses Into Tax Advantages

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

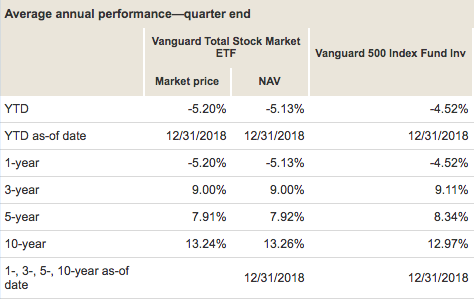

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management