peoples pension tax relief

If you pay pension contributions via the net pay arrangement before tax has been taken youll receive your full 4045 straight away without having to do anything. Write for us.

How Do Pensions Work Moneybox Save And Invest

More about workplace pension contributions.

. Special taxation arrangements apply to people aged 65 and over. For this reason taking out a large amount to put towards buying a property. Pension contributions made by the employee employer and the government this payment is known as tax relief has risen to a total minimum of 8 of qualifying earnings from April 2019.

Pensions tax relief needs reform but it should start from the top. Older peoples tax credits and reliefs. A reduced income tax rate of 75 applies in respect of income derived by registered professional football or water polo players athletes or licensed coaches.

Use this worksheet to find out how your earnings from employment will affect your State Pension Non-Contributory. The Peoples Pension slams single flat charge proposal. If youre an additional rate taxpayer ie you earn over 150000 per year and pay 45 tax on this portion you can only claim your 25 extra via a Self-Assessment tax return.

Ex-Norton owner pleads guilty to illegally investing pension funds. Call to scrap draconian MPAA as savers raid pension pots. You pay 40 tax on any total income above 50271 and 45 tax on anything above 150000 in the 20212022 tax year.

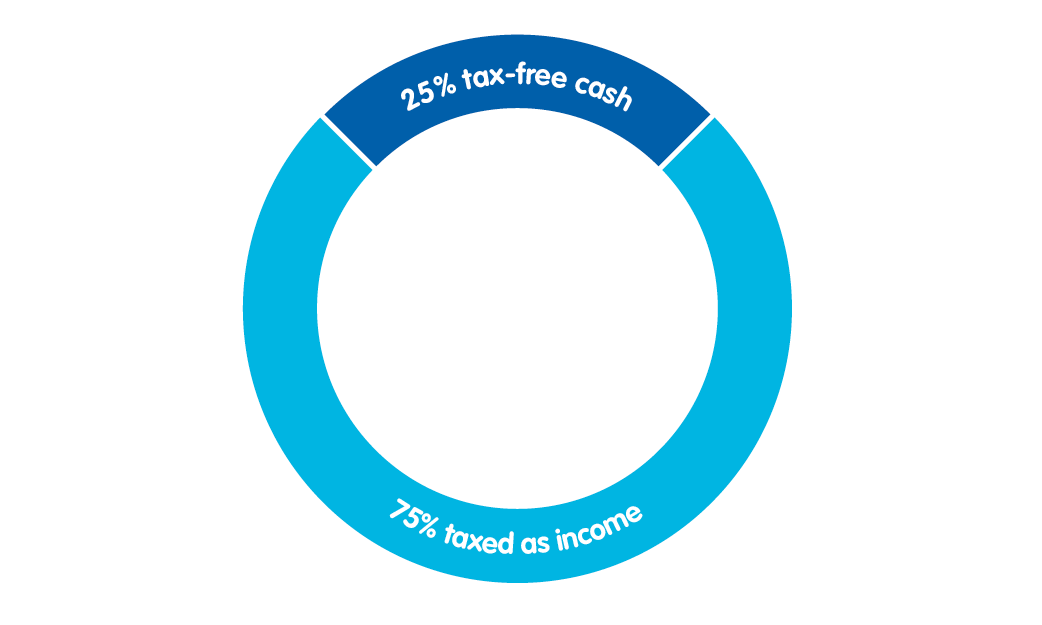

Skip to main content. Compare income tax treaties of any status from over 180 countries. The first 25 of any lump sum you withdraw from your pension can be taken tax-free but the rest will be added to your income for that year and will be taxed accordingly.

The Impermanence of Clever Things. State Pension Non-Contributory and income from work. Some experts believed that big bang tax relief may not be announced in Budget 2022.

The Living Alone Allowance. All of your dependent relatives income is included for income limit purposes. The work from home tax loophole is set to close after officials warned Rishi Sunak of the high costs reports suggest.

The said minimum tax liability of EUR 5000 should be calculated before double tax relief. OECD Opens Public Consultation on Pillar 1. Contributions to a pension are eligible for tax relief at your highest rate of tax.

Monday February 7 2022. In the budget speech it was announced that as from 2022 artists may opt to be taxed at a flat rate of 75. If you are a PAYE taxpayer and are claiming for a dependent relative the easiest way to.

The maximum of the State Pension Contributory for people over 80. Denmark and France Sign New Tax Treaty. This includes social welfare payments pensions and deposit interest.

Low earners miss out on 150m in pensions tax relief. However Economic Survey 2021-22 tabled in the Parliament on Monday January 31 2022 raised hope for bigger. The threshold income level where peoples annual earnings start being calculated for the purposes of pension tax relief is 200000.

This relief allows anyone who. LCP calls for simplified pensions tax relief limit. 2019 Azerbaijan-Bulgaria Social Security Agreement Available.

Find Out How To Claim Tax Relief For Working From Home Money Savvy Finances Money Budgeting Finances

60 Tax Relief On Pension Contributions Royal London For Advisers

Simplified Employee Pensions Plan Template Google Docs Word Apple Pages Pdf Template Net In 2022 How To Plan Pension Plan Retirement Fund

Workplace Pension Contributions The People S Pension

How Pension Tax Relief Works And How To Claim It Wealthify Com

Pension Tax Tax Relief Lifetime Allowance The People S Pension

8 Excellent Reasons Why You Should Not Opt Out Of Your Workplace Pension Tuppennys Fireplace Personal Finance Personal Finance Budget Pensions

5 Of The Best Pension Lump Sum Tax Calculators Uk Pension Retirement Planning Retirement Pension

Pension Tax Tax Relief Lifetime Allowance The People S Pension